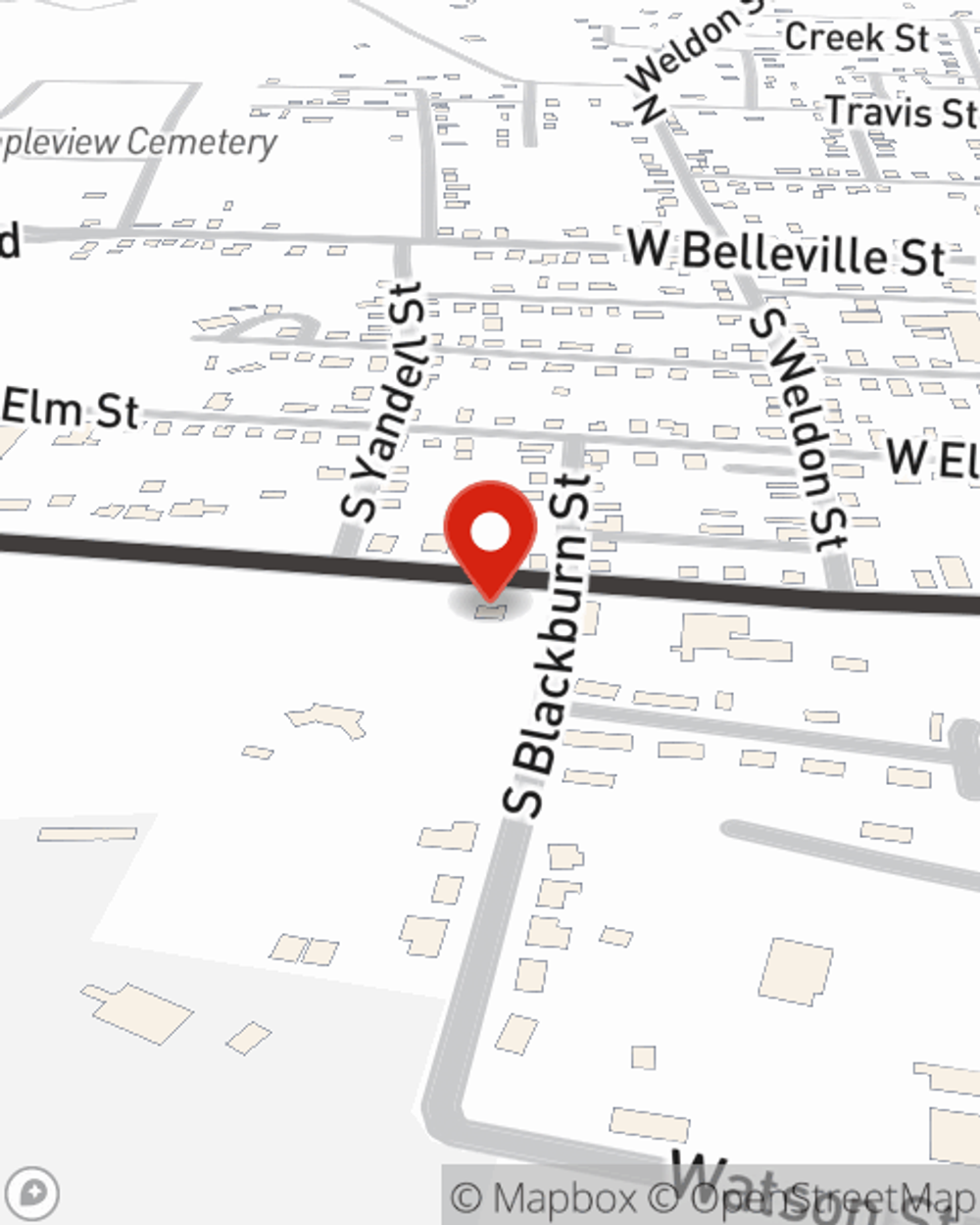

Business Insurance in and around Marion

One of Marion’s top choices for small business insurance.

This small business insurance is not risky

- marion

- salem

- smithland

- sturgis

- fredonia

- tolu

- eddyville

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, business continuity plans and errors and omissions liability, among others.

One of Marion’s top choices for small business insurance.

This small business insurance is not risky

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Tom Potter for a policy that protects your business. Your coverage can include everything from errors and omissions liability or worker's compensation for your employees to employment practices liability insurance or professional liability insurance.

Ready to talk through the business insurance options that may be right for you? Visit agent Tom Potter's office to get started!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Tom Potter

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.